With an initial contribution of as little as $1,000 in cash or appreciated assets, a Donor-Advised Fund (or DAF) is our simplest way to get started giving. You make an initial contribution, receive immediate tax benefits, and direct grants (charitable gifts) to any public nonprofit of your choice – local, regional or national. You decide the timing of your grants to charity – there is no requirement to direct a grant from your account in a given year.

Take advantage of our philanthropic and community expertise! Tell us what you’d like to accomplish with your DAF or what you care about and we’ll help you focus your resources to make the greatest impact and achieve your charitable goals. We’ll also take care of the record keeping and provide you the necessary paperwork at tax-time.

Think of it as your “charity checkbook.” A Donor-Advised Fund is a turn-key charitable and tax-planning tool.

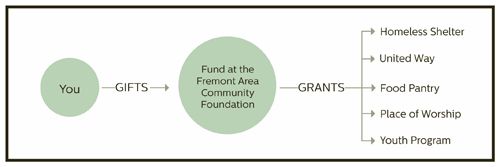

How Your Personal Gifts Become Foundation Grants

To get started all you need is five simple steps and twenty minutes:

- Contact the Fremont Area Community Foundation.

- Establish your fund with a minimum contribution of $1,000.*

- Select how you want your fund invested: endowed, non-endowed invested or pass-through.

- Choose a name for your fund. For example, “The Smith Family Donor-Advised Fund.”

- Inform the Foundation about your recommendations for grants.

*All FACF endowment funds require an initial investment of $10,000 and are subject to a spend rate limit established by the Board of Directors.

Corporate Donor-Advised Funds

Leverage your community outreach with our expertise! Establish a corporate donor-advised fund for your business to help you:

- Strengthen your connection with the community in which you work

- Make strategic and meaninful contributions and grants

- Streamline the giving process

- Manage the administration of requests and contributions

- Build corporate giving funds over time and protect giving in a “down” year.

For a printable brochure on corporate donor-advised funds, click here.

Benefits of starting a Donor-Advised Fund

- Vehicle for donors to express their unique charitable giving intentions.

- Convenience and expertise offered by the Foundation.

- Streamlines giving. The Foundation keeps track of contributions, amounts, and giving history.

- Tax advantages.

- Simplicity over other giving vehicles.

- Strategic involvement in grant making.

- Philanthropic values passed on to children and grandchildren.

- Donor’s choice of recognition or total anonymity.

For a printable brochure on donor-advised funds, click here.

Contact Melissa Diers at mdiers@facfoundation.org or 402-721-4252 to learn more about the benefits of a Donor-Advised Fund.